how much is meal tax in massachusetts

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. In general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income.

Massachusetts Who Pays 6th Edition Itep

You have reached the right spot to learn if items or services purchased in or.

/cdn.vox-cdn.com/uploads/chorus_image/image/66521458/GettyImages_528757942.0.jpg)

. The meals tax rate is. Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and. The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax.

A state sales tax. A 625 state meals tax is applied to restaurant and take-out. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625.

The meals tax rate is 625. Massachusetts local sales tax on meals. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or.

The tax is 625 of the sales price of the meal. The sale of food products for human consumption. The tax is 625 of the sales price of the meal.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Most food sold in grocery stores is exempt from sales tax entirely. The state meals tax is 625 percent. Registering with the DOR to collect the sales tax on meals.

Pay Sales or Use tax Form ST-6 or Claim an Exemption Form ST-6E with MassTaxConnect. Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Clothing purchases including shoes jackets and even costumes are exempt up to 175.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Collecting a 625 sales tax and where applicable a 75 local option meals excise on. The base state sales tax rate in Massachusetts is 625.

A state excise tax. How much is the inheritance tax in. LicenseSuite is the fastest and easiest way to get your Massachusetts meals tax restaurant tax.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The Massachusetts sales tax is imposed on sales of meals by a restaurant. This page describes the taxability of.

The Massachusetts Meals Tax rate is 625 on every meal sold by restaurants. A local option for cities or towns. Exemptions to the Massachusetts sales tax will vary by state.

The tax is levied on the sales price of the meal. A local option meals tax of 075 may be applied. Hotel rooms state tax rate is 57 845 in Boston Cambridge Worcester Chicopee Springfield and West Springfield A local option.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. How much is tax on food in Massachusetts.

Massachusetts Estate Tax Everything You Need To Know Smartasset

Is Food Taxable In Massachusetts Taxjar

Growing Up In Holyoke Ma The White Restaurant On Route 5 In Holyoke Early 1950s Menu Notice The 5 Tax On Bottom Left Of Menu The Massachusetts Old Age Tax Was

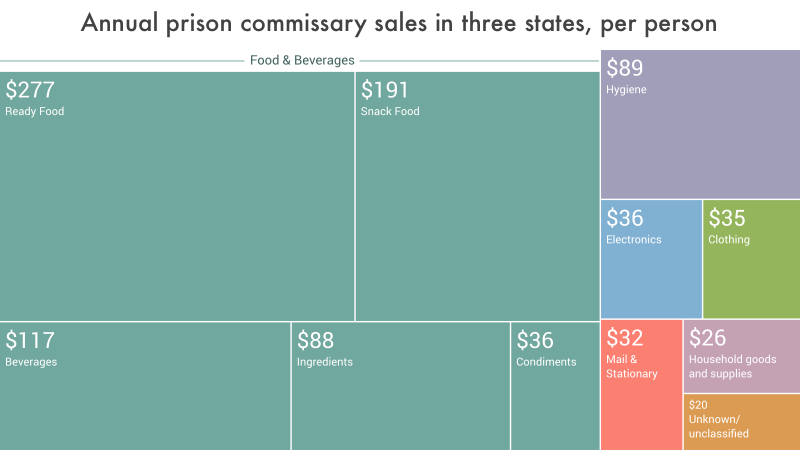

The Company Store Prison Policy Initiative

Everything You Need To Know About Restaurant Taxes

When Is Tax Free Weekend In Massachusetts Nbc Boston

New England Food Show Ma Restaurant Association Mra Recovery Update For 9 15 20 Announcement Deferring Meals Tax Due On 9 20 Https Conta Cc 3mpzt4s Facebook

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Pioneer Supports Legal Challenge To Misleading Tax Ballot Language Releases Video Economic Opportunity Latest News

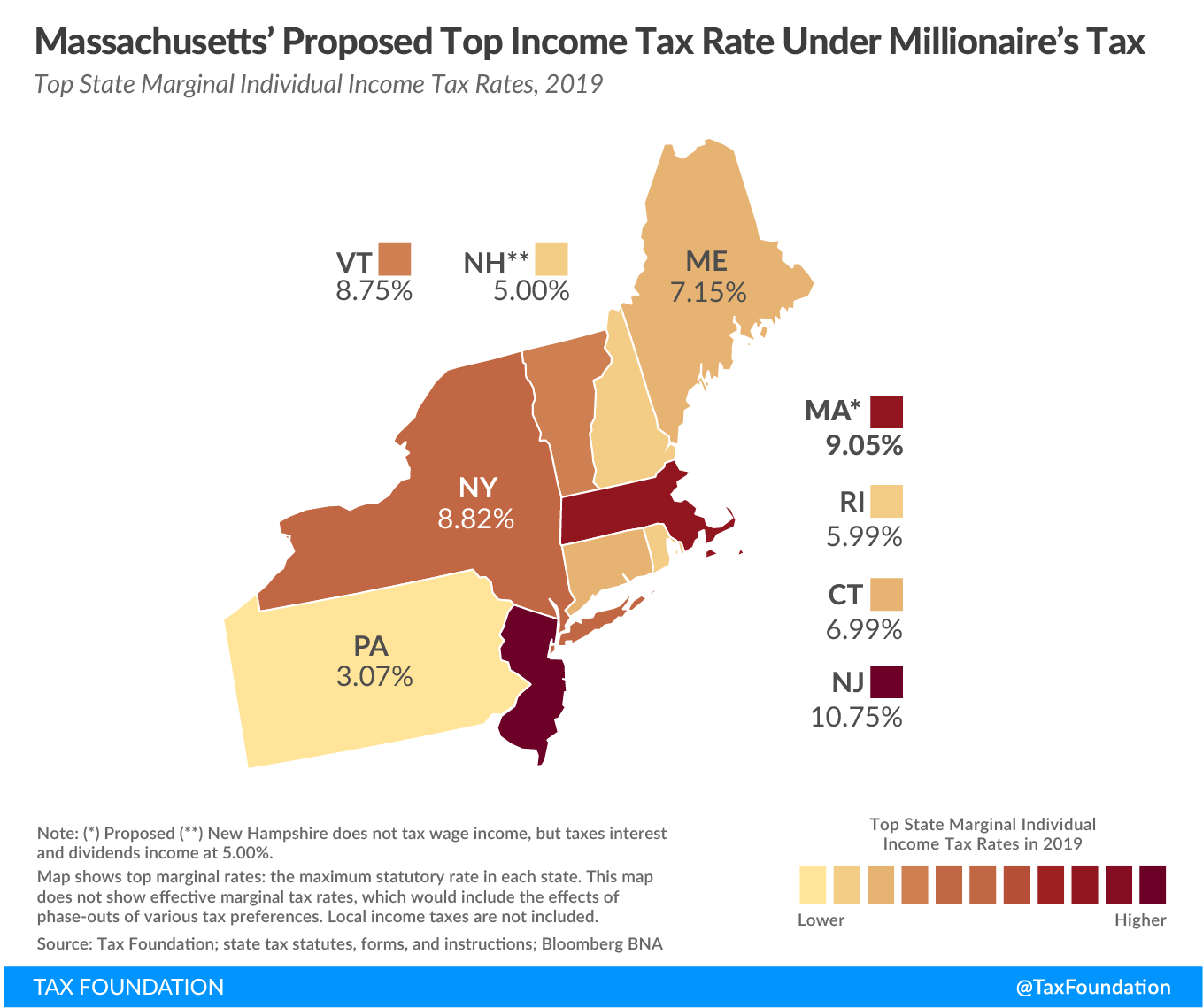

Massachusetts Legislature Moves Forward Millionaires Tax

Order Your Thanksgiving Meal From Lakeview Pavilion Foxborough Ma Patch

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

![]()

Massachusetts Income Tax Drops To 5 Flat Rate 20 Years After Passage

Tax Free Days In Massachusetts Tips Local Guide

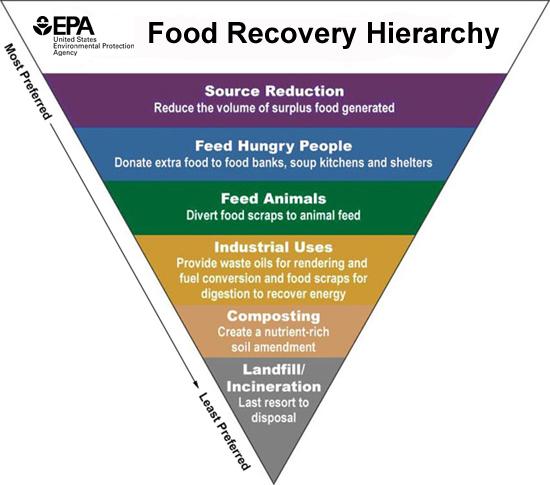

Food Donation Guidance Recyclingworks Massachusetts

Catalyst Restaurant Menu In Cambridge Massachusetts Usa

Survey Finds Solid Support For Millionaires Tax Among Would Be Voters The Boston Globe